问题

-

The company has $10 million for advertising.A、builtB、givenC、budgeted

-

How many people die from tobacco each year?A.5 million.B.8 million.C.1 billion.D.10 billio

-

This year the company won a $10 million order for oil-drilling equipment, so she knew that

-

Today it has more than 50000 head of cattle and an production of at least 10 million

-

Bertrand Russell has pointed out that happiness d

-

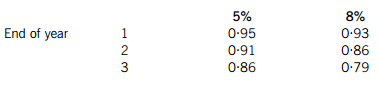

Bertrand issued $10 million convertible loan notes on 1 October 2010 that carry a nominal

最新题目

-

(a) On 1 January 2015 Palistar acquired 75% of.....

-

Crag Co has sales of $200m per year and the gross profit margin is 40%. Finished goods inv..

-

CSC Co is a health food company producing and selling three types of high-energy products:..

-

Robber Co manufactures control panels for burglar alarms a very profitable product. Every..

-

Which of the following statements is/are correct? 1 An increase in the cost of equity lead..

-

Section B – TWO questions ONLY to be attemptedAs.....

冀公网安备 13070302000102号

冀公网安备 13070302000102号