问题

-

Which of the following statements relating to In

-

Which of the following is NOT related to the mass

-

The following trial balance relates to Sandown at 30 September 2009:The following notes ar

-

The following scenario relates to questions11 to 15.The following information relates to a

-

The following trial balance relates to Sandown at 30 September 2009:The following notes ar

-

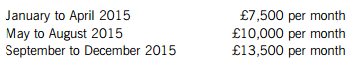

The following scenario relates to questions11 to 15.The following information relates to a

最新题目

-

The chief executive officer (CEO) of Faoilean Co has just returned from a discussion at a..

-

Putting an asset into joint names with a spouse (or a partner in a registered civil partne..

-

Which of the following government actions would lead to an increase in aggregate demand?(1..

-

IntroductionThe country of Mahem is in a long and deep economic recession with unemploymen..

-

Explain and distinguish between the following terms in relation to the doctrine of precede..

-

4 Whilst acknowledging the importance of high quality corporate reporting the recommendat..

冀公网安备 13070302000102号

冀公网安备 13070302000102号